Building Web3 Products for People with Serious Trust Issues

TABLE OF CONTENTS

Lagos, Chaos, Crypto

I was supposed to be there. The day they opened fire at Lekki Toll Gate, 20th of October, 2020. The night Lagos cracked. I remember my mom grabbing my arm, practically begging me not to leave the house. She didn’t say much. She didn’t need to. Just the look in her eyes — fear, not just for that night, but for everything boys like me had become targets for.

You learn early here that surviving as a young Nigerian man isn’t just about dodging poverty. It’s about avoiding the system, too—the uniforms, the flashing lights, the unspoken rules. If you dress too nicely, you must be a fraudster. If your phone is too clean, you must be scamming someone abroad. Wear perfume? Carry an iPhone? God help you.

I was 18 when I first stopped feeling safe around the people meant to protect us. I wasn’t a criminal. The first time I was searched, they made me unlock my phone. They dug into my emails, checked my bank apps, my notes, and even the photos in my gallery. One officer told me, “If you no be Yahoo, why you get Crypto app?” Like a crime had already happened — they just hadn’t decided which one to name it yet. If they didn’t find anything, they’d ask for a “settlement” and let you go. If they did? They’d cook the story, twist the evidence, and before you knew it, you are the headline—another name on the wrong side of justice.

So yeah, I didn’t make it to the protest. But I watched it unfold in real-time, through the cracked screen of my Android. I joined DJ Switch’s livestream on Instagram, where I witnessed the chaos, the screams, the flashing lights, and bodies scattered on the floor. It felt like the death of something, but no one knew what exactly. We didn’t know who gave the order. We didn’t know if the internet would be shut down next. We didn’t even know what the following morning would look like. But we knew, from that day forward, nothing would ever be the same. The illusion of control — gone.

That day changed something. It wasn't just about the fight against police brutality anymore. It was a wake-up call for a generation. A digital revolt sparked in a country that had long used analogue tools to keep people down. And as trust in the government, in banks, in the currency, in the very fabric of daily life eroded, a quiet migration began — one into the world of crypto. Not because it was trendy. Not because we wanted to get rich. But it felt like the only way out. The only way to move money, save value, and survive without someone breathing down your neck or reaching into your wallet.

Why Crypto in Nigeria Was Never Meant to Work

Crypto never stood a chance in Nigeria, not because it wasn’t needed, but because the system it tried to fix was never built for it to succeed. In February 2021, the Central Bank of Nigeria (CBN) banned financial institutions from facilitating crypto-related transactions. Over a single weekend, exchanges went dark, users were stranded mid-trade, and a digital economy that had just begun to bloom was aggressively pruned.

The hostility deepened in 2023 and 2024, as Nigerian authorities shifted their gaze to global players like Binance. When Binance P2P became the informal benchmark for the naira's value amid worsening inflation and capital flight, the government saw it as an existential threat. In early 2024, Nigeria detained Binance executives, cut off access to its site, and accused it of economic sabotage. The message was clear: this isn’t about protecting users; it’s about controlling the narrative.

Behind the scenes, enforcement agencies like the Nigerian Police and the EFCC started fishing expeditions disguised as investigations. Users woke up to phone calls from agents demanding explanations for crypto deposits. The financial paranoia metastasized into fear. Even innocent users began to scrub their transaction histories, worried that any trace of USDT, USDC, or crypto added to their account could invite scrutiny.

It starts with a ding. Your app shows a credit alert. It could be a freelance client or a peer-to-peer crypto buyer. You take a breath and head to your bank app, praying it works. You open it. It crashes. You try again. This time, it loads. You initiate a transfer. It freezes. You wait. Then comes the error message: "Transaction failed." Or worse: "Your account is restricted."

This is the reality of digital finance in Nigeria—a roulette wheel of system errors, delays, and untraceable funds. The term "glitch money" emerged on social media to describe the paranoia that sets in when your money enters a black box of banking failure. Banks blame networks. Networks blame apps. And you? You're stuck tweeting at your bank's customer care and tagging influencers, hoping for a miracle.

In 2024 alone, users reported thousands of cases of frozen accounts tied to crypto inflows. Sometimes, it’s an auto-flagged transaction with a crypto tag. Other times, it’s arbitrary. A bank sees multiple deposits and assumes fraud. Accounts are restricted without notice. Customer support plays dumb. And getting your funds back? A psychological war of branch visits, affidavits, and unanswered emails.

The trauma runs deep. People now lie awake at night after each transaction. They've learned to split trades across banks to minimize risk. Some keep burner accounts. Others avoid banks entirely, preferring to stash cash or rely on trusted middlemen. Crypto was supposed to unlock financial freedom. Instead, it added another layer of stress to an already exhausting system.

What do people here actually need crypto to do?

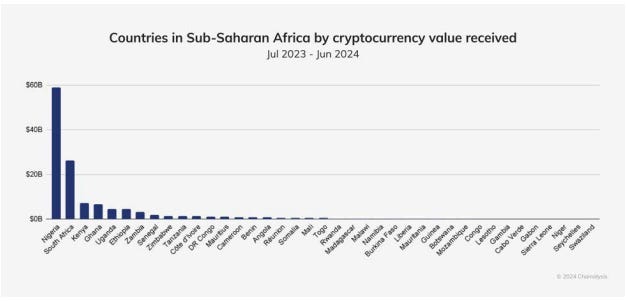

With a youth population exceeding 50 million, Nigeria is at the forefront of cryptocurrency adoption and transaction volume in Africa. In the past year, from July 2023 to June 2024, Nigeria recorded approximately $59 billion in cryptocurrency transactions.⁹ Abdul-Rasheed Dan Abu, the Head of Fintech and Innovation at the Securities and Exchange Commission (SEC) of Nigeria, acknowledged in an interview with Quidax and TechCabal Insights that although there are regulatory concerns, the demand is real and unstoppable.³⁰

Source: Chainalysis

Crypto, in Nigeria, was never about DeFi yield or DAO governance. It was about paying rent, buying data, and getting school fees across the border. But the global industry didn’t ask. They assumed users wanted what everyone else wanted: decentralization, anonymity, self-custody. What Nigerians wanted was to avoid scams, access their money quickly, and prevent their bank from flagging them.

This is why P2P took off. It was instant, frictionless, and human. You could talk to your counterparty. You could call if a transfer is delayed. The trust layer wasn’t code; it was vibes, ratings, and the knowledge that if someone messed up, you could drag them online. That’s what crypto looked like in Nigeria: a handshake deal across screens.

And this is why most polished apps failed. They demanded users conform to a model that didn’t map to reality. They focused on onboarding flows and neglected exit ramps. They hyped staking and forgot that people needed to withdraw.

The Secret Philosophy Behind Web3 in Nigeria

Before anyone in Nigeria ever compared blockchain throughput or validator rewards, they were weighing something far more personal: Will this thing survive long enough? This isn’t paranoia; it’s the residue of decades of financial betrayal. We’ve watched “wonder banks” in the 1980s promise fortunes, MMM in 2015 swallow billions, and MBA Forex quietly erase ₦213 billion between 2018 and 2021.¹⁵ We’ve seen GNLD and QNet lure job seekers into debt traps disguised as opportunity. That history doesn’t fade — it becomes the lens through which every new financial product is judged.

In a country where Ponzi schemes have burned over ₦911 billion in 23 years, the average Nigerian doesn’t ask about your roadmap — they want proof you won’t vanish. The scars run deep: MMM’s collapse left some people without school fees for their kids; agricultural “crowdfunding” cons left investors watching their farms vanish overnight.¹⁴ So when a new Crypto app arrives, people aren’t being “cynical” when they demand receipts. They’re being rational in a place where bad actors have been the norm, not the exception.

Our market isn’t drawn to DeFi because it’s shiny — it’s pulled in because the old systems keep breaking. From sudden CBN cash redesigns that invalidate your notes overnight, to inflation that quietly eats your savings, survival has turned Nigerians into some of the sharpest financial stress-testers on earth. If your product can’t withstand low-data, spotty-network, high-pressure use cases, it doesn’t matter how elegant your protocol looks in a pitch deck. In this environment, trust is built transaction by transaction and lost forever in a single failed payout.

This behavior isn’t a rejection of Web3 ideals. It’s a reminder that product-market fit requires empathy, not evangelism. You don’t onboard users here by preaching about censorship resistance. You onboard them by letting them send money to a cousin in another state without praying it doesn’t get stuck. Build trust through reliability, not rhetoric.

The psychology of mistrust, friction, and what really gets people to stick

Mistrust is our default setting. And not without reason. From bank apps freezing during fuel price hikes to network providers mysteriously “undergoing maintenance” right after salaries drop, Nigerians have learned to question everything. This bleeds into how we use Web3. Every swap is suspect until proven successful. Every bridge is a potential scam until your friend confirms they used it.

What truly gets people to stick with a protocol isn’t the promise of returns — it’s the shared stories. “Omo, I used that app and I cashed out in five minutes” is stronger than any ad campaign. Word-of-mouth is king, and trust is transferred peer-to-peer. That’s why the most powerful marketing tool isn’t an influencer post — it’s a WhatsApp screenshot showing a successful transaction.

The Nigerian crypto market has been burned before. When Patricia’s users woke up to find their accounts locked and their BTC and USDT holdings converted into “Patricia Tokens,” it wasn’t just a technical glitch — it was a deep wound to market confidence. Even after the platform’s claims of restructuring and gradual repayment, that psychological damage lingers. Incidents like that become cautionary tales, passed around in conversations and group chats, shaping which apps people will even consider trying.

Friction is tolerated only when there’s a clear reward. If your app is buggy but the arbitrage is juicy, users will adapt. But if your flow is complex and the payout is low, you’re dead in the water. The best Web3 products in Nigeria work not because they’re perfect, but because they’re predictable. And in a country where unpredictability is the norm, predictability is priceless.

Products that win in this market are built like WhatsApp: simple, direct, human-centered. That means local languages, zero-gas onboarding, and yes, a big shiny “Withdraw” button right on the home screen. And crucially, they must be bulletproof in reputation — because once trust is broken here, it’s nearly impossible to rebuild. Just ask Patricia.

Meet the Magic-Makers: Cryptonia & Paj Cash

Before Cryptonia and Paj Cash emerged, the Nigerian crypto landscape was a brutal arena. If you participated in P2P trades, you were gambling—not with your money, but with your safety, freedom, and sanity. You’d send USDC to a buyer and then wait. And wait. And sometimes, never hear back. Maybe they blocked you. Perhaps they just forgot.

Meanwhile, your money was gone. Panic would set in. You’d call 30, 40 times—leave dozens of frantic messages. Maybe you were in a taxi, trying to make a payment. Perhaps you needed the naira for a hospital bill. It didn’t matter. The person on the other end had no obligation, no urgency.

Worse still was when they did send money, only for it to be flagged as "fraudulent" by your bank—dirty money. Suddenly, your account is frozen. You're standing in a bank lobby trying to explain how you’re not a scammer while an angry bank manager insists you return the funds immediately. You’re stuck. You can’t access your own money, and there's no regulator to call. No crypto ombudsman. You’re just one more name in a long list of frozen accounts.

This wasn’t edge-case behavior—it was the norm. Some buyers would send less than the agreed rate. Others would disappear entirely. And every time, you knew you had no recourse. No legal backup. You were hustling in a lawless market, where the only rule was: Don’t get burned.

Cryptonia, founded by Oluwasanmi Timilehin, didn’t start with seed rounds or VCs—it started with $5 million in OTC trades in four years of grit.³⁸ Paj Cash didn’t start with an app. It began with protocol logic: how to convert Solana tokens to Naira without middlemen, trust games, or waiting in the darkness of Telegram groups.

What they really do is solve the Nigerian crypto off-ramping problem—fast, reliably, and without drama. Cryptonia promises USDT/USDC to naira in under 10 seconds. Paj Cash says: “Just send tokens—Naira will follow.” And it does. That’s not just product design. That’s a trauma response. These platforms are less about crypto and more about giving Nigerian users their time, sanity, and dignity back.

To understand Cryptonia and Paj Cash, you have to look beyond UI and APIs. These are not “just products.” They’re behavioral infrastructure—tools that shape how people behave, feel, and trust in an economy where every transaction could go wrong.

These platforms relieve psychological burden. P2P meant constant vigilance. Cryptonia and Paj Cash remove the need for that. No more chasing strangers and no more explaining crypto to suspicious bank staff. They replace anxiety with certainty. That’s not a UX improvement—it’s behavioral liberation.

What’s My Definition of PMF?

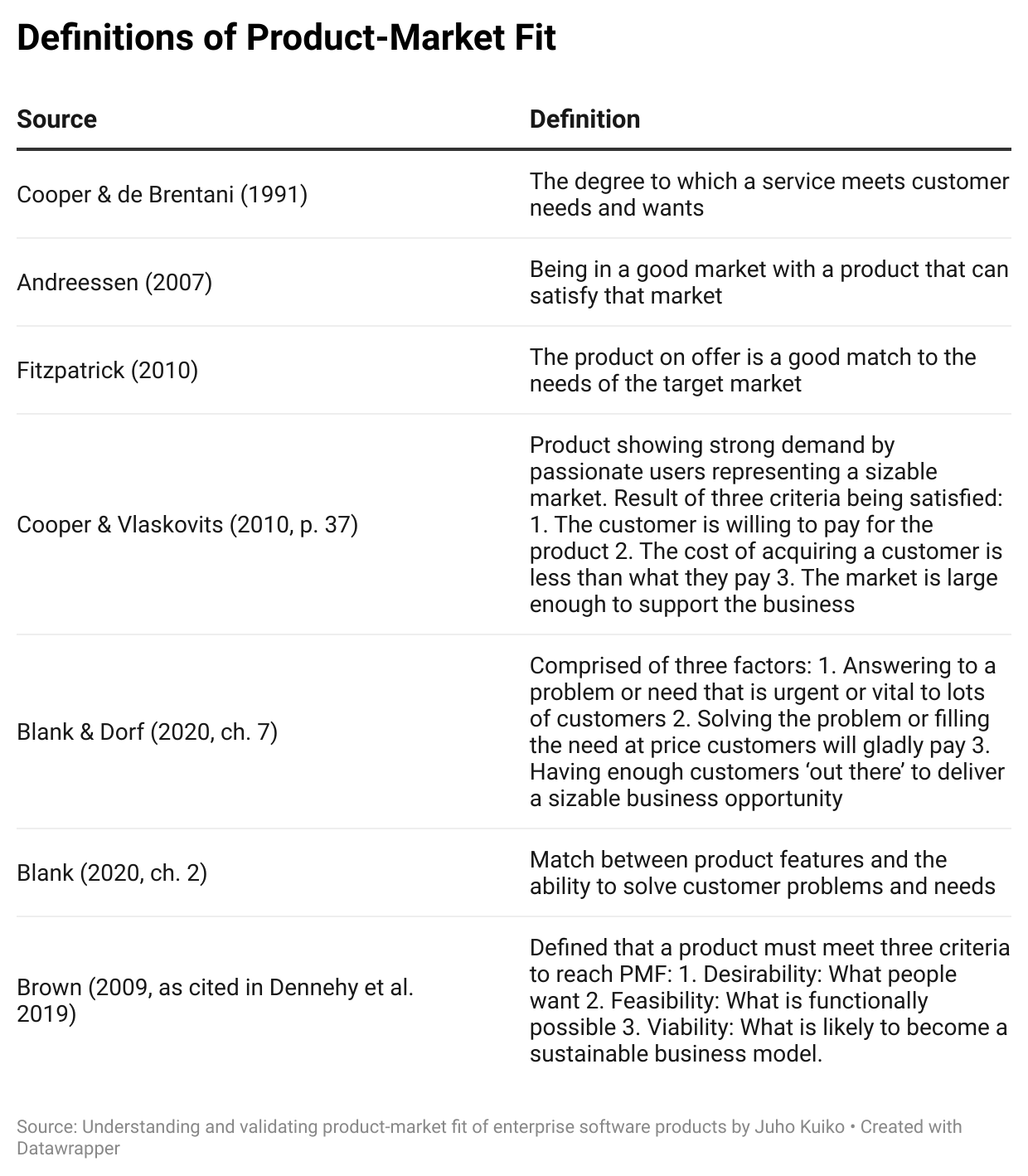

In management and innovation research, Product-Market Fit (PMF) has often been framed through the “jobs to be done” theory — the idea that consumption is driven by the tasks people are trying to solve, whether that’s spending less time in a queue or finding new career paths. Successful products, as Christensen et al. (2016) explain, emerge when companies understand those “jobs” better than existing solutions.²¹

While some scholars argue PMF is a binary state — either you have it or you don’t (Ries 2011; Eisenmann et al. 2013) — others see it as a spectrum, where a “good enough” fit can still sustain traction (Cooper & de Brentani 1991). What most agree on, however, is its importance: without PMF, demand falters, and startups fail (Andreessen 2007). Research in the financial sector, for instance, showed that products with strong PMF strongly correlated with success, while poor PMF led to failure (Cooper & de Brentani, 1991).²¹

The lean startup playbook emphasizes that scaling should not begin until PMF is reached. Premature scaling often leads to wasted resources, poor retention, and lost agility (Leslie & Holloway, 2006; Eisenmann et al., 2013). In fact, Andreessen (2007) goes as far as suggesting that PMF is the only thing that matters in a startup’s early life cycle.²¹

Let’s leave the theory for a second. For me, PMF isn’t best understood in a framework or investor slide — it’s what happens on the ground. It’s the moment your product stops feeling like a pitch and starts behaving like a habit. It’s when users no longer need convincing because they’re already reshaping their daily routines around what you’ve built, sharing it with friends, and defending it as though it’s theirs.

It looks different for every project. For one founder, PMF is when the product can survive without marketing spend. For another, it’s a community buzzing at 3 AM, solving problems unprompted. At its core, PMF is less about what you claim in a deck and more about what your users do when no one’s looking.

That’s why, when I looked at Cryptonia and PAJ Cash, I didn’t find PMF in their glossy pitch materials. I found it in their numbers — not random spikes, but breadcrumbs pointing to acceptance. The market had not just tested them; it had adopted them, maybe even claimed them as its own.

The Metrics That Made Me Choose Cryptonia and PAJ Cash

Let’s start with PAJ Cash. On May 21, 2025, they hit 400 community members on Telegram. You might think, so what? But communities don’t grow because the founder said, “Please join.” They grow because people feel there’s something worth showing up for. By June 4, they had already processed 2,500 transactions — and those aren’t “sign-ups” or “page views,” they’re actual moments of trust where money moved. Two weeks later, they celebrated 1,000 users (June 20), and by July 18, they’d processed $100,000.³⁹

Now look at Cryptonia. On April 13, 2025, they crossed 1,000 users. By June 10, they had already paid out ₦100 million in-app within just four months. That’s not “engagement,” that’s raw cash flow going through the platform — the kind of figure that makes even skeptics raise an eyebrow. Then July 30 rolled around, and they weren’t at 1k users anymore — they were sitting comfortably above 5,000.³⁸

But here’s where I got convinced: back between January and April, they’d already clocked $1M+ in OTC volume, $20K+ in app transaction volume, and over 1,200 completed transactions. These aren’t vanity metrics. These are the kinds of stats that scream, people aren’t just trying the product — they’re relying on it.³⁸

When you stitch those milestones together, you get a clear picture: both PAJ Cash and Cryptonia are past the “convince me” stage. Their users aren’t just using them; they’re building routines, communities, and trust around them. And that — more than any chart or consultant-approved framework — is my definition of PMF in action.

Design Like You Live There

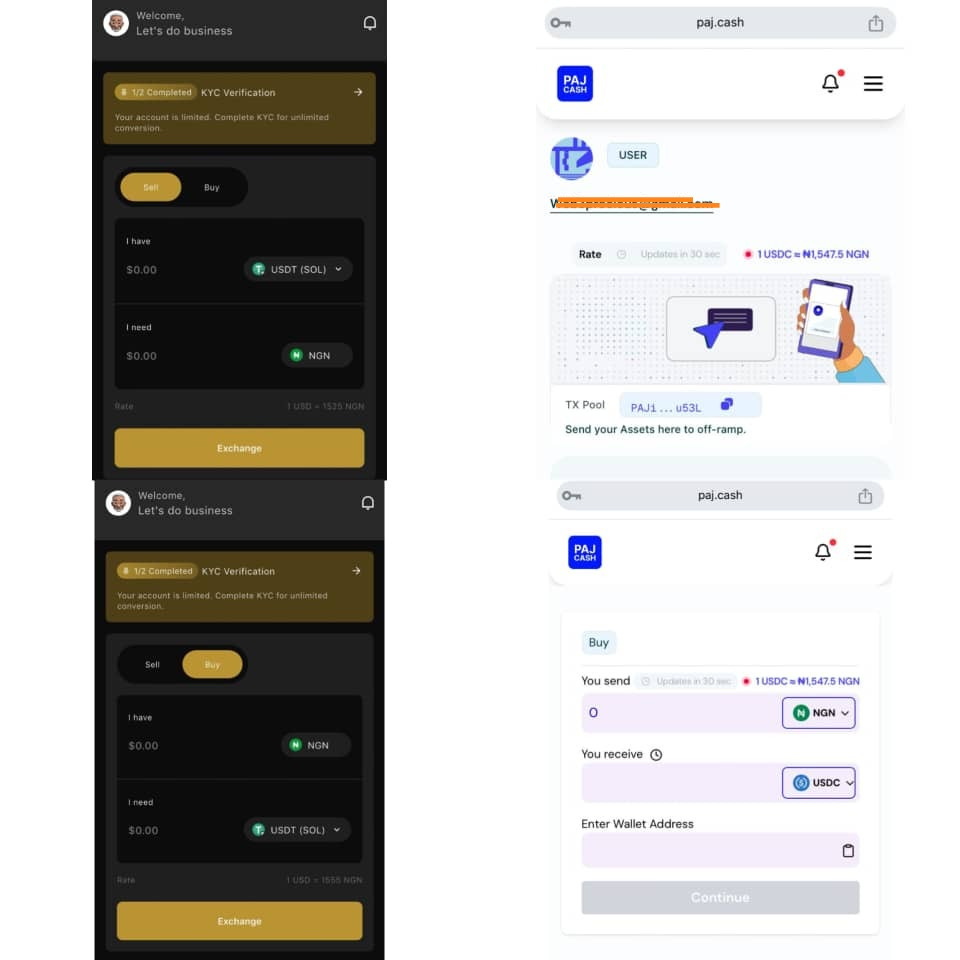

On the streets of Lagos, patience isn’t a virtue—it’s a liability. You’re either fast or forgotten. The same applies when converting USDT to naira. Cryptonia and PAJ Cash understood this from the start. They don’t overwhelm you with long, buggy feature updates or flashy designs. They focus on what matters most: Withdraw.

On Cryptonia, signing up is simple: click the bold golden “Sign Up” button, input your username, email, and optionally a referral code (currently offering 100 points per referral). Signing in brings you to “Welcome Back,” with options to log in using email and password, fingerprint, or phone password.

The app has four main tabs: Home, History, Referral, and More. Under “More,” you can change your name or profile photo, complete verification, add a bank account, access Help & Support, or rate the app. Cryptonia also sends pop-up reminders about the current rates. Note: for security, closing the app logs you out, so you sign in again on reopening. Just verifying your email could allow you to offramp up to $5,000 — heaven for the average Nigerian who worries someone can empty their bank account with just a BVN.

PAJ Cash keeps users signed in for days, as long as the browser tab remains open. To use it, you link the wallet you’re offramping from and add a bank account to receive payments. PAJ doesn’t hold funds; it only has permission to view balances and activity on the connected wallet.

The interface includes a menu with Home, Wallet, Buy, Referrals, TX Pools (to monitor ongoing transactions), and TX History. You can even offramp as little as 0.5 USDC. As PAJ Cash puts it, "if you no get money, show your face."

Paj Cash’s invisible wallet system and easy webpage on/off-ramps prove it wasn’t designed for the ideal Web3 user. It’s for the overworked remote worker, the graphics designer cashing out from a gig, or the Solana degen in Ibadan. You don’t even feel like you’re using a web3 web app—no seed phrases, no “connect wallet” pop-ups. Send tokens, and five minutes later, you’re holding naira.

The interface doesn’t feel like a crypto platform. It feels like a bank app designed by someone who actually uses it. You drop your email, send tokens to the address given, and money lands in your account—no Telegram merchant middlemen, no “Hey bro, I’m coming” messages.

The “jargon cleanse”

Try explaining liquidity staking and yield farming to a freelance video editor trying to offramp his $75. They don’t care. The only APR they care about is "how fast can I get paid?" Cryptonia and Paj Cash got this memo early. Their entire design language feels more like mobile money apps than crypto terminals.

You won’t find terms like slippage tolerance or wrapped tokens in their UI. What you will find are familiar words like “Exchange,” “Sell,” “Buy,” and “Bank Account.” They didn’t just simplify the interface; they localized it.

In Nigeria, recharging your phone is second nature. Open an app, type an amount, confirm, and boom—airtime lands in seconds. That’s the user journey every crypto product here should mimic. Paj and Cryptonia both nailed this because they didn’t chase Silicon Valley design fantasies. They chased the telco UX Nigerians already use 10 times a week.

That’s why Cryptonia’s flow feels like topping up MTN. It’s not just simple; it’s familiar. Paj Cash is even more radical. No dashboards. No wallet balances. You enter the site like you’re about to buy airtime, but instead, you’re receiving naira.

This design philosophy is not just about usability. It’s about trust. It tells the user: we know how you think, and we won’t waste your time. That’s what happens when you design like you live there.

Why not Solana?

The question isn’t ‘Why Solana?’ ‘It’s Why not Solana?’ If your goal is product–market fit, you don’t waste time on a blockchain still searching for it. You go where PMF is already alive, where your users already exist, so you’re not starting from zero, trying to re-educate them.

Africa is no longer the “potential” market people once talked about in conference panels — it’s already here. In two years, crypto adoption on the continent has doubled, hitting 75 million wallet users in 2025. Stablecoins account for 68% of wallet-based online purchases. Last year, Africa recorded the fastest year-on-year growth rate in the world, at +38%, led by Nigeria, Kenya, and South Africa. This isn’t a sleeping market. It’s a moving train.¹⁰

Most people will tell you that Solana’s big selling point is speed and low fees, but the real strength is stability. On Solana, sending a transaction costs about $0.000025. Ethereum L2s like Base or Arbitrum average $0.005 — that’s 250 times more expensive, and those are “good-day” prices.³⁶ In congestion, Ethereum’s costs can spike, and your $1 payment can be quickly consumed by gas fees. Solana’s costs don’t flinch. Even in the wildest network traffic, it maintains stable speed and cost, so builders don’t wake up to the nightmare of $40 gas when their users are trying to pay $2.

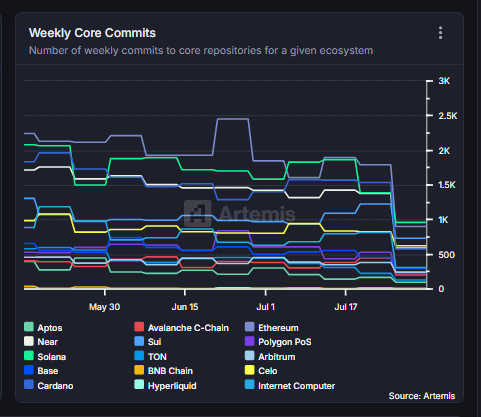

Source: Artemis

If you’re building for actual usage, the crowd is already in the room. It’s the same with developers — weekly commits to core repos show Solana ahead of Ethereum by over 61 commits, and it’s not just quiet code pushes.⁵ The Solana Developers Forum is active, discussing protocol proposals (SIMDs) and application standards (SRFCs), a sign that this ecosystem is actually listening and evolving.

This responsiveness matters when you’re building in a place like Nigeria, where there is no proper electricity, roads are more potholes than tar, your passport is more a prison than a pass, and the economy has perfected the art of moving in the wrong direction. Yet, in that chaos, Solana spotlighted over 10 African products recently — seven from Nigeria alone — all tied to the SuperteamNG community.³³ That’s not just marketing fluff; that’s a global blockchain saying we see you, we value you, and giving builders from Lagos to Nairobi the same stage as anyone in New York or Berlin.

So, why not Solana? Because if you’re serious about scale, stability, cost-efficiency, and building where both the users and the builders are already active, the better question is what you’re still waiting for.

The SuperteamNG Effect

SuperteamNG is one of the largest web3 communities in Africa, led by Nzube Ezudo and Harri Obi, with thousands of developers, content creators, researchers, designers, community managers, and marketers with over 33,000 followers on X and more than 10,000 active users on Discord.³⁵

SuperteamNG’s influence spans 2,300 events hosted so far, drawing a combined 78,100 attendees both virtually and in real life. This thriving ecosystem has generated nearly $936,000 in community GDP, distributing over $331,000 in grants, $366,000 in bounties, and nearly $170,000 in hackathon prizes to fuel innovation as of the end of July 2025.³⁵

Some accelerators give you mentorship. Others hand you a small check. But SuperteamNG, a community of Solana believers in Nigeria, outworks them all—it turns working products into cultural moments. For PAJ Cash, its participation in SuperteamNG’s Startup Village didn’t just give visibility—it gave them velocity.³⁹

PAJ Cash came in hot, fresh out of protocol testing with barely a UI to boast about. But by the end of that week, they’d tripled their transaction volume, deployed upgrades in real-time, and earned the top spot in the village.³⁹ That wasn’t luck. That was validation through execution. Not just from judges, but users. For Cryptonia, SuperteamNG helped take a quiet OTC player and put them on the map as one of the most reliable crypto off-ramps in the country.³⁸

They don’t just give winners applause—they give them users, feedback loops, and most importantly, belief. The kind of belief that makes you ship at 2 AM because someone, somewhere in Nigeria, needs to off-ramp tonight. Looking for a community that gets you your first 100 users? Well, now you know about SuperteamNG.

References

Ademola, Bakare. “Cryptocurrency Trading: CBN Orders Banks to Close Operating Accounts.” CBN Update, February 2021. https://www.cbn.gov.ng/out/2021/ccd/volume%203%20number%202%20cbn%20update%20february%202021.pdf.

Adetutu Sobowale. “Full List: Firms That Left Nigeria from 2020 to 2024 over Economic Challenges.” Punch, 2024. https://punchng.com/full-list-firms-that-left-nigeria-from-2020-to-2024-over-economic-challenges/.

African Business. Dulue Mbachu. “Nigeria to Allow Cryptocurrencies in New Law While Targeting Risk.” African Business, March 2025. https://african.business/2025/03/finance-services/nigeria-to-allow-cryptocurrencies-in-new-law-while-targeting-risk.

Akinmodun, Peretimi, Tiwalola Osazuwa, Mubaraq Popoola, and Akintunde Agunbiade. “Overview of Nigeria’s Dynamic Cryptocurrency Regulatory Landscape.” Securities and Exchange Commission Nigeria. https://home.sec.gov.ng/our-mandate/development/business-insights/sec-policies-on-cryptocurrency-and-crypto-assets/.

Artemis Analytics. “Chains Comparison.” Accessed August 2025. https://app.artemisanalytics.com/chains?selectedChains=aptos%2Cavalanche%2Cethereum%2Cnear%2Csui%2Cpolygon%2Csolana%2Cton%2Carbitrum%2Cbase%2Cbsc%2Ccelo%2Ccardano%2Chyperliquid%2Chyperevm%2Cinternet-computer.

BBC News. Nkechi Ogbonna. “Why Nigeria’s Economy Is in Such a Mess.” BBC News Africa, Lagos, February 2024. https://www.bbc.com/news/world-africa-68402662.

Binance. “Binance Announces Sudden Exit from Nigeria’s Financial Ecosystem — What’s Going On?” Gresyndale Legal, June 9, 2023. https://gresyndale.com/binance-announces-sudden-exit-from-nigerias-financial-ecosystem-whats-really-going-on/.

Central Bank of Nigeria. Guidelines on Operations of Bank Accounts for Virtual Assets Service Providers (VASPs). Abuja: CBN Financial Policy & Regulation Department, 2024. https://www.cbn.gov.ng/out/2024/fprd/guidelines%20on%20operations%20of%20bank%20accounts%20for%20virtual%20asset%20providers.pdf

Chainalysis. The 2024 Geography of Cryptocurrency Report. October 2024. https://www.chainalysis.com/wp-content/uploads/2024/10/the-2024-geography-of-crypto-report-release.pdf.

Coinlaw. “Cryptocurrency Wallet Adoption Statistics.” Accessed August 2025. https://coinlaw.io/cryptocurrency-wallet-adoption-statistics/#Most-Popular-Cryptocurrency-Wallet-Providers.

Degen House. “Why Build Blockchain Products on Solana.” Accessed August 2025. https://www.degen.house/blog-posts/why-build-blockchain-projects-on-solana

Disruption Banking. Harry Clynch. “Is Crypto to Blame for the Weakness of the Nigerian Naira (NGN)?” Disruption Banking, March 28, 2024. https://www.disruptionbanking.com/2024/03/28/is-crypto-to-blame-for-the-weakness-of-the-nigerian-naira-ngn/.

EFCC. Solomon Odeniyi, Onozure Dania, and Ademola Adegbite. “Corrupt Politicians Using Crypto Wallets to Launder Money – EFCC Chair.” Punch, 2025. https://punchng.com/corrupt-politicians-using-crypto-wallets-to-launder-money-efcc-chair/.

Fintech Magazine Africa. “Part 1: The Ponzi Schemes in Nigeria: A History of Exploitation.” Fintech Magazine Africa, April 16, 2025. https://fintechmagazine.africa/2025/04/16/part-1-the-ponzi-schemes-in-nigeria-a-history-of-exploitation/.

From Lagos To The World Powered By TTT Media. “NeoLife, GNLD & QNet: Unveiling the Hidden Dangers Behind Nigeria’s ‘Job’ Scams.” Medium, June 8, 2025. https://medium.com/@FromLagosto/neolife-gnld-qnet-unveiling-the-hidden-dangers-behind-nigerias-job-scams-cb65148449e2.

Guardian. “Nigeria Sues Crypto Giant Binance for $81.5bn in Economic Losses and Back Tax.” The Guardian, February 19, 2025. https://www.theguardian.com/technology/2025/feb/19/nigeria-binance-crypto-lawsuit.

Harri, Obi. “Blockchain, Cybersecurity, and State Sovereignty: Emerging Models for Nigeria’s Digital Future.” Harri’s Substack, 2025. https://harriobi.substack.com

Jookyung Ree. “Nigeria’s eNaira, One Year After.” IMF Working Papers, 2023. https://drive.google.com/file/d/1guPvnUSP8LC5QdOapGliVg0GkJK9T1WG/view?usp=sharing

Kate. “The Full History of the Nigeria CBDC Failure.” The Coin Zone, 2024. https://www.thecoinzone.com/cbdc/nigeria-cbdc-failure.

Khadija, Yusra Sanusi. “How Has Nigeria’s e-Currency Fared Since Its Launch?” Al Jazeera, May 23, 2022. https://www.aljazeera.com/features/2022/5/23/how-has-nigerias-e-currency-fared-since-introduction.

Kuiko, Juho. Understanding and Validating Product-Market Fit of Enterprise Software Products. Tampere: Tampere University, 2021. https://trepo.tuni.fi/bitstream/handle/10024/133879/KuikoJuho.pdf?sequence=2

Lawal, Temitayo. “Nigeria’s Digital Currency Can’t Compete with Crypto.” Rest of World, 2023. https://restofworld.org/2023/nigeria-digital-currency-failing/.

Mailchimp. “What Is Product-Market Fit?” Mailchimp Resources. https://mailchimp.com/resources/product-market-fit/.

New Lines Magazine. Kingsley Charles. “The Rise and Fall of Cryptocurrency in Nigeria.” New Lines Magazine, 2025. https://newlinesmag.com/reportage/the-rise-and-fall-of-cryptocurrency-in-nigeria/.

Nigerian Info FM. “SEC Working on Stablecoin Regulation Framework.” Nigeria Info FM, 2024. https://www.nigeriainfo.fm/news/homepagelagos/sec-working-on-stablecoin-regulation-framework/.

Nigerian court drops charges against detained Binance executive Tigran Gambaryan. The Record, 2025. https://therecord.media/nigerian-court-drops-charges-tigran-gambaryan-binance-executive.

Nwosu, Emmanuel. “Crypto’s Dark Side: How P2P Traders Navigate Daily Scams, Fraud, and Frozen Accounts.” TechCabal, March 3, 2025. https://techcabal.com/2025/03/03/how-p2p-traders-navigate-daily-scams-fraud-and-frozen-accounts/.

Obasesam, Okoi, and MaryAnne Iwara. “The Failure of Governance in Nigeria: An Epistocratic Challenge.” Georgetown Journal of International Affairs, April 12, 2021. https://gjia.georgetown.edu/2021/04/12/the-failure-of-governance-in-nigeria-an-epistocratic-challenge/.

ProductPlan. “What Is Product-Market Fit?” ProductPlan. https://www.productplan.com/glossary/product-market-fit/.

Quidax and Techcabal Insights. The Rise of OTC and Stablecoins: Africa's Quiet FX Revolution. August 2025.

Salako, Pelumi. “‘I Invested in a Ponzi Scheme’: Nigerians Fall Victim to Crypto Scams.” Al Jazeera, June 11, 2025. https://www.aljazeera.com/features/2025/6/11/i-invested-in-a-ponzi-scheme-nigerians-fall-victim-to-crypto-scams.

Sanusi, Khadija Yusra. “How Has Nigeria’s e-Currency Fared Since Its Launch?” Al Jazeera, 2022. https://www.aljazeera.com/features/2022/5/23/how-has-nigerias-e-currency-fared-since-introduction

Solana. “Guest Thread by Harri Obi.” X (Twitter). Accessed August 2025. https://x.com/solana/status/1954958199465054556?t=2V2x2cRos0GdHf6_LJBoGw&s=19.

Solana Developers Forum. “Protocol Proposals (SIMDs) & Standards (SRFCs).” Accessed August 2025. https://forum.solana.com/c/simd/5.

Superteam Nigeria. “Builders, Bounties and Bridges – July Recap.” Superteam Nigeria Substack, July 2025. https://superteamnigeria.substack.com/p/builders-bounties-and-bridges-july

Syndica. “Insights: Layer 1 & 2 Chains - March 2025.” Accessed August 2025. https://blog.syndica.io/insights-layer-1-2-chains/.

Viva Technology. “Product-Market Fit: Its Importance, Definitions, and Examples.” Viva Technology, 2024. https://vivatechnology.com/news/product-market-fit-its-importance-definitions-and-examples.

Web3Precious. “Cryptonia | Unpacking Innovation 007.” Web3Precious’ Substack, 2025. https://web3precious.substack.com/p/cryptonia-unpacking-innovation-007

Web3Precious. “PAJ Cash | Unpacking Innovation 006.” Web3Precious’ Substack, 2025. https://web3precious.substack.com/p/paj-cash-unpacking-innovation-006

Wikipedia. “End SARS.” Wikipedia. https://en.wikipedia.org/wiki/End_SARS.